Payday Loans for Short-Term Financial Solutions

Payday Loans for Short-Term Financial Solutions

Blog Article

Secure Your Future With Tailored Online Loans From Specialist Car Loan Provider

In today's ever-evolving and hectic economic landscape, securing your future typically calls for strategic planning and notified decision-making when it involves handling your finances. Tailored on the internet loans provided by expert financing services have become a prominent selection for people looking for economic assistance. These services not only offer comfort but also offer tailored funding alternatives that deal with individual needs and situations. Navigating the world of online lendings can be daunting without the best knowledge and assistance. By comprehending the benefits, choosing the right solution, deciphering the terms, and taking essential steps to secure your financing, you can lead the way for a monetarily safe and secure future. Just how can you make certain that you are optimizing the capacity of your online financing to attain long-lasting success? Let's discover the vital techniques and factors to consider that can assist you maximize your customized on the internet lending and established yourself up for a flourishing future.

Benefits of Tailored Online Loans

Tailored online financings use a myriad of benefits for people seeking personalized financial solutions in today's electronic age. With online finance services, debtors can use for finances from the convenience of their homes or workplaces, removing the demand to visit physical branches.

Moreover, customized on the internet fundings typically feature fast approval processes. By leveraging electronic modern technology, loan providers can expedite the verification and authorization procedures, permitting customers to access funds in a prompt fashion. This fast turn-around time can be essential for individuals dealing with immediate unanticipated expenses or economic needs.

Just How to Select the Right Lending Solution

Given the variety of customized online funding options available today, choosing the appropriate car loan service that straightens with your details financial requirements calls for cautious consideration and notified decision-making. To start, determine your monetary objectives and the objective of the car loan. Comprehending just how much you need to borrow and for what certain factor will assist limit the options readily available.

Next, contrast interest rates, charges, and payment terms from numerous loan services. Seek clear lenders who give clear info on their terms. Think about trustworthy finance services that have positive client testimonials and a history of trustworthy service. Additionally, assess the level of consumer support supplied by the car loan solution, as having accessibility to responsive support can be essential throughout the finance process.

Moreover, evaluate the versatility of the car loan service in regards to settlement options and potential expansions. Guarantee that the finance solution aligns with your financial capacities and supplies a payment strategy that fits your budget plan. By taking these variables right into account, you can make a notified decision and select the ideal lending service that finest fits your monetary needs.

Recognizing Finance Conditions

Recognizing the intricacies of loan conditions is crucial for borrowers seeking to make well-informed monetary decisions. Loan terms and conditions lay out the specifics of the contract in quick loans no credit check between the debtor and the lending institution, consisting of the financing quantity, rate of interest, repayment schedule, fees, and any various other pertinent information. payday loans. It is crucial for borrowers to carefully review and understand these terms prior to consenting to a finance to stay clear of any kind of shocks or challenges down the line

One trick element of finance terms is the rate of interest, which figures out the expense of obtaining money. Customers need to pay very close attention to whether the rates of interest is dealt with or variable, as this can impact the overall quantity settled over the life of the lending. Additionally, understanding any type of fees related to the financing, such as source charges or early repayment charges, is necessary for budgeting and preparation objectives.

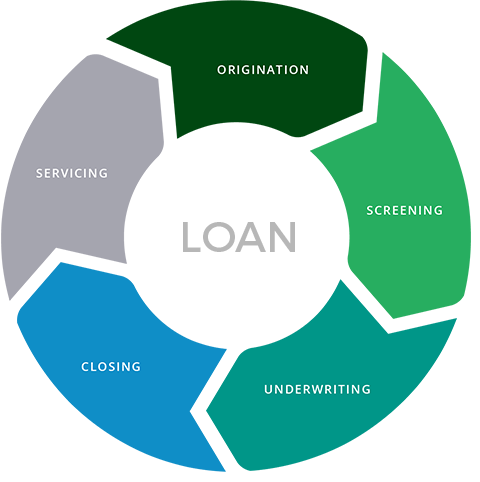

Actions to Safeguard Your Online Funding

Before waging securing an on the internet loan, consumers should initially ensure they thoroughly understand the conditions outlined by the lending institution. When the terms are clear, the next action is to collect all necessary documents. Lenders normally discover here require personal identification, proof of income, and banking details. It is critical to have these files conveniently offered to accelerate the lending application procedure.

After collecting the required paperwork, debtors need to investigate various finance alternatives available to them. Contrasting rate of interest, settlement terms, and any kind of added fees will certainly help customers make an informed decision - payday loans near me. Once a suitable loan choice is chosen, the application process can begin. This normally involves completing an on the internet application form and sending the needed records for confirmation.

Maximizing Your Finance for Future Success

To take advantage of the full possibility of your financing for future success, tactical economic planning is essential. Begin by describing clear purposes for just how the lending will be used to move your monetary endeavors onward. Whether it be purchasing more education, broadening your company, or consolidating current financial debts, a well-balanced strategy is loan for land purchase critical. Make the most of the influence of your car loan by taking into consideration the long-term implications of your financial choices. Assess the rate of interest, payment terms, and potential returns on investment to make sure that the loan lines up with your goals. Furthermore, explore ways to maximize your budget to fit loan settlements without endangering your financial stability. By staying arranged and disciplined in your approach to handling the car loan, you can establish yourself up for future success. Regularly monitor your progression, make modifications as required, and look for assistance from financial experts to make informed decisions. With a calculated state of mind and prudent monetary administration, your finance can serve as a stepping rock towards attaining your long-lasting purposes.

Conclusion

Finally, customized on-line lendings from expert financing services provide countless advantages for securing your future monetary stability. By thoroughly picking the ideal funding solution, recognizing the problems and terms, and complying with the needed steps to secure your loan, you can maximize its capacity for future success. It is essential to come close to on-line financings with care and ensure that you are making educated choices to accomplish your monetary objectives.

Report this page